Understanding How Daily Payment Loans Work

Find Out How Much Cash Your Business Could Receive

Daily Payment Business Loans Get You Funds Fast

Daily payment business loans are a flexible, fast way to pay off loans quickly while managing your business’ cash flow. Daily payment business loans are designed to help business owners manage their loan payments and maintain a steady cash flow. This type of financing can support your day-to-day organizational needs to keep things running smoothly.

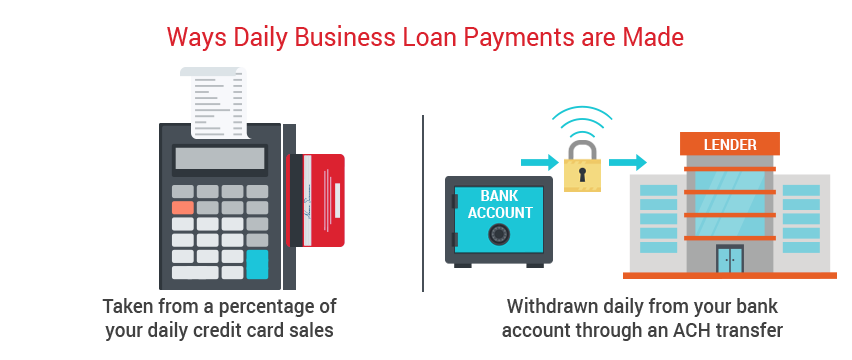

Electronic payments are the most common way to make a payment. According to Nacha, the administrator of the ACH Network, an electronic payment system, ACH volume reached 30 billion payments in 2023. While many loan agreements require a monthly or even weekly payment, a daily payment loan can typically be paid off faster. This is often ideal for business owners who want to manage their business credit and cash flow, while keeping their daily operations running.

If you’re interested in getting quick access to cash to support your small business, consider looking into daily payment business loans from an alternative lender, like QuickBridge. Here’s all you need to know about this type of small business loans.

What Are Daily Payment Business Loans?

A daily payment business loan is a type of short-term financing that gives small businesses the quick access to cash they need when dealing with unexpected expenses. Daily payment business loans usually have short terms, typically anywhere between three and 18 months. With this funding, business owners make a small payment every single day until the loan is paid off. This unique repayment structure allows for the quick turnaround rates of these loans.

A daily payments program for loans makes it fast and efficient for business owners to pay off the loan. A daily payment loan is ideally suited for businesses who have a steady cash flow and need funds upfront. Whether you want to capitalize on an opportunity or need cash for an unexpected expense, a daily payment loan is a fast, flexible way to reach your goals.

Are Daily Payments the Right Loan Type for Your Business?

Daily payment business loans are often a good fit for small businesses when they come across immediate expenses. For example, let’s consider a car wash business. When one of the major parts of the car wash breaks, the business owner may need to shut down operations while getting the money to replace or fix this feature. A daily payment program for companies offers the quick cash needed to keep things moving. With this financing, the carwash business owner can get fast access to capital, which they can put toward repairs and replacements. That means instead of closing their business for weeks, they can be back up and running in just a few days. In this instance, daily payment business loans prevent the car wash owner from missing out on profits and demand.

Daily payment programs for small businesses are best suited for businesses working in industries that generate cash flow every day, such as restaurants, retailers, car washes, and others.

Why Choose QuickBridge for a Daily Payment Loan?

Simple application process

Business loans of up to $500K

Receive funds within days

No hidden fees

Early payoff discounts

Flexible loan term options

Understanding Your Loan Options

When you’ve decided that it’s the right time to secure daily payment business loans, you might be wondering how to get them. There are many lenders that provide daily payment business financing, but the two major sources of these loans are traditional banks and alternative lenders.

Traditional Bank Loans

A traditional bank can offer a daily payment loan program, but it isn’t common. Most bank loan programs are longer-term loan contracts, meaning a daily payment isn’t always an option. These loan types typically have payment terms anywhere from one to five years.

Alternative Lenders

Alternative lenders, like QuickBridge, offer flexible requirements and terms to meet the needs of small business owners. Alternative lenders typically specialize in short-term financing with terms anywhere from three to 18 months. The quick turnaround makes it efficient to offer a daily payment program to meet the needs of businesses with strong daily cash flow.

Requirements for Daily Payment Business Loans

A daily payment business loan is a fast, simple way to get funds for your business. QuickBridge offers flexible eligibility requirements, so you’ll find it easier to get the funds you need. To be eligible, it’s recommended to have:

- At least six months in business

- Minimum $250,000 in annual sales

- Fair to excellent credit

Applying for Daily Payment Business Loans

Applying for a daily payment business loan with QuickBridge is easy. You’ll simply fill out our quick application online – make sure you have your bank statements and credit score on hand. Then, one of our funding advisors will help find the best loan option to suit your needs. Here they will discuss your options, including payment terms. Once approved, funds can be deposited in as little as 24 hours. Fast, simple, and easy – that’s the QuickBridge way.